The world is changing. What were once investment options reserved for the already wealthy, are now becoming more and more accessible to smaller-scale investors. Within the last ten years, we have seen the likes of crypto, and personal investor apps dominate the conversation in the public sphere. Because of this, smaller private investors have seen the market’s general attitude shift to emphasize these technologies as a new frontier that’s just daring to be explored. But you see, the thing about exploring is; you rarely know where you’re going. That’s why we wanted to create this guide, to show you some options for your portfolio, and hopefully offer a little guidance for your financial journey!

The Neo-Goldrush

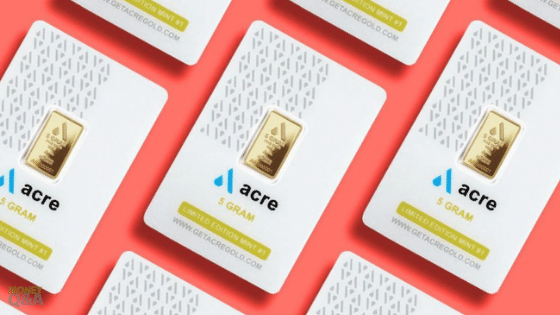

If there was one ineffable symbol for currency in the world. It would be gold. With a historical significance so vast that the color is inextricably linked to the very idea of currency. It’s easy for it to seem unattainable to the general public. Well then let me tell you about Acre Gold! They are a monthly subscription-based service that revolutionized the way we buy gold. How it works is that you can invest a monthly sum into your account, and every time the money in your account reaches the price of a gold bar; they send one straight to your door! The company also offers a variety of subscription options that suit all levels of investors. This is a momentous achievement for private investment and serves as an excellent opportunity to diversify your assets through a universally recognized option.

Meeting Your Mutuals

Our next listing takes more of a passive investment approach but has the potential to yield great dividends. I’m talking of course about investing in a mutual fund. Now there are many different kinds of these funds out there, and they all have their strengths and weaknesses. But for this article, we are going to focus on, stock funds. Stock funds are a kind of mutual fund that balances a risk/reward ratio to yield the highest return possible. Of course, due to being tied to the stock market, this makes stock funds a more volatile type of mutual fund. But in our eyes the potential gross you can make from this endeavor highly outweighs the risk!

Seizing The Day

Since we’ve shown you one of the more passive paths to investment, let’s grab some coffee rev up our engines, and talk about some of the benefits of becoming a day to day trader. Now we should warn you this type of investor is someone who is self-directed, goal-oriented, and willing to put in the time and effort to make this form of investment viable. If this doesn’t sound like you there is no shame in that, and we encourage you to move on to our next topic. Now for the rest of us sharks out there. Let’s get started. There are many ways to go about day trading, but the core principles are to take advantage of the minute fluctuations in the market to make a high volume of low-yield maneuvers. These individual trades can start to add up very quickly, but where the real finesse lies, is in the management of these multiple streams of income. You need to keep a firm hand on the wheel as you trade as timing in these situations is everything. But once your sense for the rhythm of the market is in a place few other strategies can yield as high a return.

Capitalizing With Crypto

Crypto-currency is an emerging market in which investors can take advantage of. It is unique in the fact that crypto can be sold incrementally, making it a great option for all sizes of investment. For this article, we’re going to keep it simple by focusing on smaller forms of crypto investment. Many different services facilitate this. We suggest using Robinhood, or Cash App as they seem to be the most forward-thinking of these types of service. We suggest this level of investment for beginners, as it’s a manageable and easy-to-understand strategy that can show the benefits of having multiple passive revenue streams.

The road of the investor can be a difficult one. With so many options and the myriad idiosyncrasies, you need to keep track of, it’s easy to feel that investment is out of your reach. We hope that this guide was not only able to illuminate some of your lingering questions, but also show that investment is for everybody and not just a select few!