An HRA exemption calculator is an online tool to help you find the amount of House Rent Allowance (HRA) you are eligible to claim a tax exemption on.

All employees receive a House Rent Allowance (HRA) as part of their wage package. It is a sum provided to you as a component of your pay by your company. As an assessee, you can seek tax breaks on the sum you spend for rent annually. This is in accordance with Section 10 (13A) of the IT Act.

Who can claim House Rent Allowance?

To be qualified for the HRA tax break, you must do the following:

- Be a paid employee with an HRA provision in your wage structure, and

- Live in leased housing

However, if you are not currently receiving HRA as a component in your pay stub, you can still seek Tax deduction under Section 80GG of the IT Act. The requirements are:

- You must be employed or self-employed.

- You did not get House Rent Allowance at any stage throughout the fiscal year when you are claiming tax benefit under Section 80GG.

- You and your spouse do not own any dwelling property in the area where you presently reside.

Amount of Tax Deduction

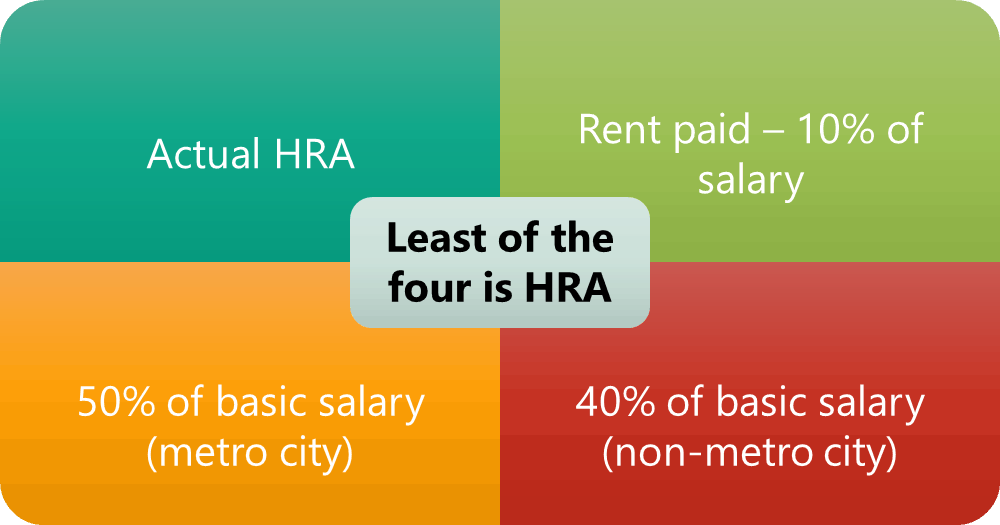

Your HRA tax deduction is the minimum amount between:

- Your actual HRA amount received,

- (DA + Basic Salary) x 50% if you are residing in a metro city i.e. Mumbai, Delhi, Chennai, or Kolkata.

(DA + Basic Salary) x 40% if you are not residing in a metro city.

- The actual rent amount paid – 10% of (DA + Basic Salary)

Understand that the smallest sum from the four possibilities listed above is considered for tax exemption. As a result, if you intend to get the most out of it, you should talk to your boss about it and reorganize your income accordingly.

Calculation of HRA exemption and Benefits of HRA exemption Calculator

The major advantage of the HRA is that it may be used to lower taxable earnings, resulting in a drop in the amount of tax you need to pay. Let’s look at a test environment to see how HRA exemption is determined.

Consider yourself to be in Delhi. You are paid a monthly salary of 40,000 INR with a Dearness Allowance of 10,000 INR. Your income includes an HRA amount of 25,000 INR; however, the monthly rent you spend is 20,000 INR. According to the aforesaid circumstances, the following amount is exempt from tax.

- Your actual HRA amount received = 25,000 x 12 = 3,00,000 INR

- Since you are residing in a metro city, Delhi, your second option will be

(DA + Basic Salary) x 50% = (40,000 + 10,000) x 12 x 50% = 50,000 x 12 x 50% = 6,00,000 x 50% = 3,00,000 INR

- The actual rent amount paid – 10% of (DA + Basic Salary) = 20,000 x 12 – 10 % of (40,000 + 10,000) x 12 = 2,40,000 – 10% x 6,00,000 = 2,40,000 – 60,000 = 1,80,000 INR

In this case, 1,80,000 INR is the smallest amount available. As a result, you would be excused from tax for 1,80,000 INR.

Online HRA exemption calculators make this job much easier. You just need to input your annual salary, receive dearness allowance, receive House Rent Allowances, and Total Paid Rent amount. You need to tick a checkbox if you are residing in a metro city i.e. Mumbai, Delhi, Chennai, or Kolkata.

The calculator will do the calculations for you and provide you with the amount eligible for HRA exemption and the amount you need to pay taxes under House Rent Allowances.

What effect does the revised tax scheme have on House Rent Allowance?

Only if you choose the old tax system can you proceed to seek HRA exemption. Note that the new tax system eliminates all exemptions and deductions, apart from the National Pension Scheme contributions (up to 50,000 INR) and house loan interest (up to 2,00,000 INR).

So, if you are paying taxes in the old tax regime, have a Home Loan as well as currently reside in leased housing, feel free to take advantage of the twofold tax advantages each year.

To learn more about HRA, click here.

Conclusion

Of the current taxation policies that are in place, house rent allowance looks like a perk that is bound to stay. This policy allows companies to offer better perks to their employees. It also opens up new employment opportunities as it helps businesses attract talent from all over the country.

The calculations for HRA as well as its various components may seem a little bit complicated but are made easy with the use of an HRA exemption calculator. Using an online HRA exemption calculator is sure to help you get the right figures in place and help you calculate amounts accurately.